Our goal is to help entrepreneurs from all over Europe look further forward to achieve top-level results and performance. For this reason, we report the main tax, legal and business news implemented in Italy, the Czech Republic, Portugal, Romania and Albania. The aim is to update our clients with all the opportunities offered by the different states to be competitive in a globalized economic environment.

Italy – Special tax regime clarified for remote workers employed by a foreign employer

On 28 December 2020, with Circular Letter No. 33/E, the Italian tax authorities provided important clarifications about the Italian special taxation regime applicable to employees who move their tax residency to Italy, also in light of the legislative updates introduced on 30 April 2019 by Law Decree No. 34/2019 and subsequent amendments.

For eligible individuals who moved their tax residency to Italy after 30 April 2019, the special tax regime consists of a 70% exemption applicable to employment income produced in Italy, for an initial period of five tax years.

The exemption rate is raised to 90% for individuals who move their tax residency to the following Italian regions of South Italy: Abruzzo, Molise, Campania, Puglia, Basilicata, Calabria, Sardinia, and Sicily. In addition, if some further eligibility conditions are satisfied, the initial five-year period may be extended another five years, up to maximum duration of ten tax years.

The Italian tax authorities confirmed that, according to the current version of the Italian special taxation regime, eligible individuals are not required anymore to perform their work activity within an Italian resident company, one or controlled or connected to an Italian resident company.

Therefore, if all the requirements to access the regime are satisfied, the exemption also can apply to employment income produced by individuals who move their tax residency to Italy to perform therein remote work for an employer based abroad.

In detail, individuals moving to Italy to perform remote work for a non-Italian employer may access the special taxation regime, benefiting from a 70% exemption from the taxation of the employment income produced in Italy (raised to 90% for individuals who move to regions of Southern Italy), for an initial period of five tax years.

Partner of Horizon Consulting in Italy – www.studiomoretti.net

Czech Republic – Outlook 2021

The Czech Republic’s ‘AA-‘ rating balances its track record of stable macroeconomic, fiscal and monetary policies, robust institutional framework, and a large external creditor position against lower GDP per capita and weaker governance indicators than peers.

The Stable Outlook reflects Fitch’s expectation that a strong policy framework and measured policy response will help the economy absorb the Covid-19-related shock to domestic and external demand and lead the public debt ratio to stabilise in 2022 at a level still comfortably below the ‘AA’ median, as the crisis response is unwound and the economy recovers.

The Covid-19 pandemic, which triggered severe restrictions on economic activity and mobility, led to an estimated 7% contraction in the economy in 2020, with all components of demand except government consumption negatively affected.

The experts expect the economy to recover as restrictions are phased out and vaccinations increase. EU-financed investment, recovering exports, and a still strong labour market, also support growth that is forecast at 4.1% in 2021 and 4.9% in 2022, higher than the forecast ‘AA’ median growth rates.

Next Generation EU (NGEU) funds will have a notable impact on growth in 2022, when the Czech Republic is likely to receive around 60% of its allocation (equivalent to EUR4.8 billion). The experts estimate the cumulative impact on GDP growth in 2021-22 from the NGEU at 2.1pp.

Partner of Horizon Consulting in Czech Republic – www.kampacons.cz

Portugal – Types of Commercial Companies in Portugal

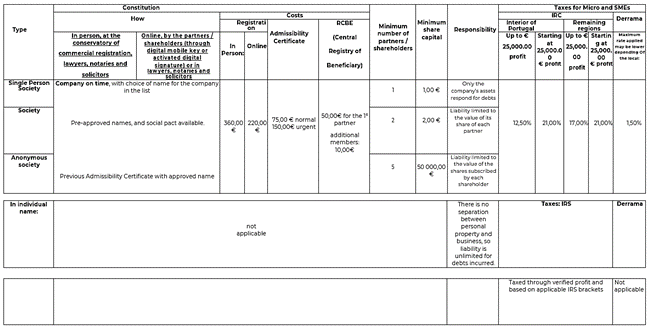

Entrepreneurs from abroad can easily set up varied types of companies. When a foreign investor decides to set up a company in Portugal, he/she must decide from the beginning upon the type of company he wants to establish. The Company Law in Portugal sets several types of structures from which a foreigner can choose. It follows a list of different legal forms of companies, divided into two categories – individual and collective.

The entrepeneurs should consider the strengths of the future company, the assets to be allocated, the type of responsibility, and the required capital investment. Last but not least, you must decide if it is an adventure that you intend to conduct alone or with other partners.

Partner of Horizon Consulting in Portugal – www.visar.pt

Romania – New tax facilities

VAT news for 2021:

- The ceiling for the application of VAT on collection is increased from 2,250,000 lei (462.000 EUR) to 4,500,000 lei (923.800 EUR).

- The deadline until which VAT refunds are made with subsequent control is January 25, 2021.

- From the point of view of VAT, transactions with the UK will follow the rule of extra-Community transactions from 2021 onwards.

- VAT may be deducted on alcoholic beverages and tobacco and in a situation other than in cases where these beverages are intended for resale or to be used for services.

VAT can thus be deducted for the free provision of goods for advertising purposes or to stimulate sales.

- The value ceiling for the delivery of low-rate housing (5%) to individuals is modified, now having the value of 140,000 euros, the old ceiling being 450,000 lei.

Specifically, this reduced rate of 5% will apply to the delivery of homes that have a usable area of up to 120 square meters, excluding household annexes, whose value, including the land on which they are built, does not exceed 140,000 euros, equivalent to lei , excluding VAT, purchased by individuals.

Partner of Horizon Consulting in Romania – www.hirzaconsult.ro & www.contamar.ro

Albania – Albania the ideal destination for many investors

In the center of the Balkans, located between Greece, Italy, Montenegro and North Macedonia, Albania is one of the most stable countries from a political and economic point of view in the Western Balkans. Actions at the policy level aim at developing the tertiary sector, IT and tourism.

Albania for 2021 is considered an excellent country to invest in, full of opportunities, endowment of physical capital and low-cost labor.

In recent years, the country has embarked on an internal reform process, aimed at bringing its institutional, administrative and legal system closer to Western standards and has strongly wanted to make it the most competitive country in terms of taxation. For this reason, from 1 January 2021 the tax on profits of small businesses in the turnover range from 0 to 115,000 euros per year will be zero.

For companies that have a turnover of over 14 million lek per year, the tax on profits will be 15%, while the tax on dividends will be 8%.

The IT and automotive sectors that are considered priorities for the country’s economic development have a fixed income tax of 5%. In addition, the Albanian government strongly wanted to support small businesses, ensuring that businesses with a turnover of up to 64,000 euros will be exempt from VAT.

In addition to the very advantageous tax regime for businesses, Albania remains very competitive also in terms of labor costs. The minimum wage in Albania is 243 euros.

The average gross salary is 425 euros, roughly a quarter of that of the European Union average of 1966 euros and a fifth of the Italian one, which is 2277 euros (Eurostat, 2019). The cost of hourly labor is among the lowest in the Balkan area and is approximately 2.3 euros per hour against 27.7 euros which is the European Union average or against 28.8 euros which is in Italy (Eurostat, 2019).

The cost of labor and the tax burden (27.9%) make Albania the most attractive country for the Balkan area due to the relocation of production (about 350 Italian companies with a turnover exceeding 2 million euros have opened an office in Albania, the total number of Italian companies in Albania are about 2000 in total.

Italian companies and beyond, choose Albania both for the cost of labor and the tax burden but also for the simplicity of opening and managing a company with little money. An SRL in Albani can be opened in less than 48 hours and there is no need for share capital. A local administrator costs on average 300 euros per month. That is, Albania is a non-bureaucratic country for opening and managing companies.

Partner of Horizon Consulting in Albania – www.expertaconsult.com and PhD Klodian Muço

For any further information, do not hesitate to contact us!

You can find us in Italy, Albania, Czech Republic, Hungary, Poland, Portugal, Slovakia, Romania, Russia and UAE.

previous post

previous post